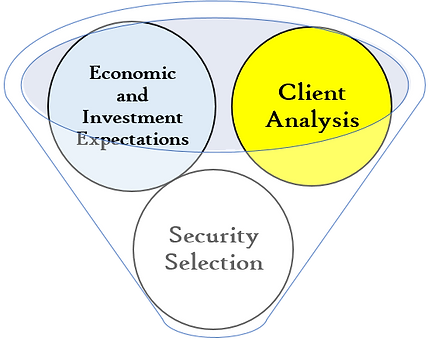

A Summary of Our Investment Management Process

Client Analysis – Determining the Strategic Asset Allocation

We start by determining the investor's return requirement and risk tolerance, subject to the investor's current wealth and constraints. With this information we can determine the strategic asset allocation that best meets the objectives defined in the investment policy statement (IPS), subject to any other limitations specified by the investor.

Economic, Investment and Capital Market Expectations

All portfolios, regardless of risk and return objectives, have one of three tactical tilts based on our capital market expectations. These tactical shifts are conducted by formulating long-term capital market expectations and their potential effects on the various asset classes.

Security Selection Process

Maintain a fluid inventory of securities used in the Strategic and Tactical allocation process. This is done through intense due diligence and attribution analysis for the most effective exposures to asset classes and strategies. Careful consideration is given to underlying holdings to eliminate potential concentration risk to certain asset classes and strategies.

Stress Testing the Portfolio:

Stress Testing is about assessing the potential impact of economic scenarios have on your investments. We create what-if scenarios to model recessions and other economic events. Creating these scenarios allows us to look at your portfolio risks against a variety of economic and market scenario outcomes, covering a range of possible events.

Client Portfolio:

Monitor the portfolio regularly. A feedback loop is included so changes in long-term market factors can be incorporated into the model and to determine whether adjustments to the strategic allocation are justified. If market changes are short-term, tactical allocation measures will be considered.

Client Analysis – Determining the Strategic Asset Allocation

We start by determining the investor's return requirement and risk tolerance, subject to the investor's current wealth and constraints. With this information we can determine the strategic asset allocation that best meets the objectives defined in the investment policy statement (IPS), subject to any other limitations specified by the investor.

Finding the right portfolio based on client characteristics

Business Cycle Indicators to set our Economic, Investment and Capital Market Expectations

1. Initial Recovery:

Duration of a few months, business confidence is rising.

Government stimulation is provided by low interest rates and/or budget deficits.

Falling inflation, large output gap.

Low or falling short-term interest rates.

Bond yields are bottoming out, Rising stock prices.

Cyclical, riskier assets such as small-cap stocks and high yield bonds do well.

3. Late Upswing:

Output gap eliminated and economy at risk of overheating.

Central Bank limits the growth of the money supply.

Rising stock prices, but increased risk and volatility.

Confidence and employment are high.

Rising short-term interest rates.

Rising Bond Yields.

Inflation Increases.

2. Early Upswing:

Duration of a year to several years.

Increasing growth with low inflation.

Rising short-term interest rates.

Output gap is narrowing.

Flat of rising bond yields.

Increasing confidence.

Increasing inventories.

Rising stock prices.

4. Slowdown:

Declining confidence.

Inflation is still rising.

Falling stock prices.

Falling inventory levels.

Short-term interest rates are at a peak.

Duration of a few months to a year or longer.

Bond yields have peaked and may be falling,

resulting in rising bond prices.

5. Recession:

Duration of six months to a year.

Large declines in inventory.

Declining confidence and profits.

Inflation tops out.

Falling short-term interest rates.

Falling bond yields, rising prices.

Stock prices increase during the latter stages anticipating the end of the recession.

RISK ON – Overweight economically sensitive asset classes and strategies

NEUTRAL – Hold market weight asset allocations

RISK OFF – Underweight economically sensitive asset classes and strategies

RISK ON

NEUTRAL

RISK OFF

RISK ON

RISK ON

RISK OFF

RISK OFF

NEUTRAL

NEUTRAL

Understanding the Strategic Allocation and the Tactical Tilts within Client Portfolios

Each client will generally fall within the definition of characteristics that define the portfolios from Ultra Conservative to Ultra Aggressive. A client with a “Balanced Risk” portfolio, regardless of the stage of the market cycle, would have 50% of their portfolio invested in asset classes that have historically exhibited risk and return characteristics of Fixed Income Investments and 50% to assets that exhibited risk and return characteristics like equites. That is not to say that they will be invested 50% in fixed income and 50% in equities. Different asset classes perform more favorably than other assets depending on the stage in the economic cycle. We fill in the “like” assets that historically exhibited the best relative performance given the stage of the economic cycle while mitigating the risk and return to fall in line for an investors Strategic Allocation.

As example, John, a client at Alternative Capitalis is in his late 50’s and plans to retire in 7 years. He is in his best earning years of his career. Financially and emotionally he has lower tolerance for uncertainty regarding long term portfolio value but can handle short-term portfolio volatility. He still is looking for portfolio appreciation but wants a balanced approach to mitigating risk in turn for reasonable returns. John would meet the definition of a “balanced” investor at Alternative Capitalis. If Alternative Capitalis has a capital market expectation that the economy is in the “late upswing” stage of the economic cycle then they will strategically “Tilt” the portfolio to a “RISK OFF” portfolio that is intended to outperform an otherwise “Neutral” or “RISK ON” portfolio in a “late upswing” stage. The critical, and most difficult task is correctly recognizing the stage of the economic cycle.

Investments involve risk and unless otherwise stated, are not guaranteed.

Disclosure

WARRANTIES & DISCLAIMERS

There are no warranties implied.

The illustrations and examples above are hypothetical in nature. This website and information are provided for guidance and information purposes only. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.

Alternative Capitalis, LLC (“RIA Firm”) is a registered investment adviser located in Massachusetts. Alternative Capitalis, LLC may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Alternative Capitalis, LLC’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Alternative Capitalis, LLC’s web site on the Internet should not be construed by any consumer and/or prospective client as Alternative Capitalis, LLC’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Alternative Capitalis, LLC with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Alternative Capitalis, LLC, please contact the state securities regulators for those states in which Alternative Capitalis, LLC maintains a registration filing. A copy of Alternative Capitalis, LLC’s current written disclosure statement discussing Alternative Capitalis, LLC’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Alternative Capitalis, LLC upon written request. Alternative Capitalis, LLC does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Alternative Capitalis, LLC’s web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.